Hi, welcome to Gasgoo. In this episode of “Wheels of Change: Stories of Chinese Auto Giants,” let’s talk about China first car manufacturer FAW.

To Be a Bigger and Stronger Chinese Independent Brand

As the pioneer of China's automotive industry, FAW's natural mission is to persist in independent innovation and strengthen the independent brand.

After quickly resuming production through a partnership with Audi in 1996, the Hongqi brand suffered setbacks, with market performance and reputation falling short of expectations. It wasn't until 2017 that FAW Hongqi experienced a turnaround.

In July 2017, Mr. Xu Liuping, who was then leading Changan Automobile Group, was transferred to Changchun to take charge of FAW Group. After taking office, Xu Liuping set three main focuses for FAW Group: to fully build its own brand and rapidly improve its independent innovation capabilities; to continue to pursue joint ventures and partnerships; and to further strengthen Party building and anti-corruption efforts.

On January 8, 2018, FAW launched the new Hongqi brand strategy with the determination to make the new Hongqi a new nobility brand that is "No. 1 in China and famous in the world". To achieve this goal, the Hongqi product lineup was divided into four series: the L series for top luxury vehicles, the S series for coupes, the Q series for commercial vehicles, and the H series for mass-market cars.

In its mass-market lineup, Hongqi has successively launched a variety of models such as the Hongqi H7/H5, Hongqi HS7/HS5, and Hongqi H9, helping the brand's sales surge from around 5,000 units in 2017 to a record 370,000 units in 2023, achieving 74-fold growth in six years.

FAW has mobilized the entire group's resources to revitalize the Hongqi brand, which is particularly evident in its R&D investment. FAW's average R&D expenditure accounts for 3% of sales revenue, with the largest portion allocated to the Hongqi brand, more than 10%.

In terms of R&D layout, FAW has established a "One Headquarters, Four Institutes" R&D system and a "Three Countries, Five Locations" global R&D network to meet the demands of mastering and applying the latest global technologies.

Specifically, FAW’s global R&D headquarters is located in Changchun and consists of the Hongqi Design Center, the NEV R&D Center and the ICV R&D Center. FAW has also established the Foresight Tech Innovation Center and the Experience Perception and Measuring Center in Beijing, and the NEV R&D branch in Shanghai. FAW has set up the Hongqi Forsight-Looking Design Branch in Munich, Germany and the AI R&D Branch in Silicon Valley, USA.

In addition, FAW has established a technology development company in Nanjing to attract domestic professional talents in the AI field for the research and development of technologies related to AI and other foresight intelligent connections. FAW has also established a vehicle testing base in Hainan and an ICVs testing ground in Shandong, aiming to create a world-class research and testing platform for intelligent vehicles and intelligent transportation.

Compared to Hongqi, the Bestune brand was not as lucky. Due to a poor partnership between FCC and Mazda, technical cooperation between Bestune and Mazda gradually weakened after the establishment of Changan Mazda in 2012. After the launch of the upgraded Bestune B70 in 2014, the brand has had no new models based on Mazda platforms.

Photo credit: Bestune

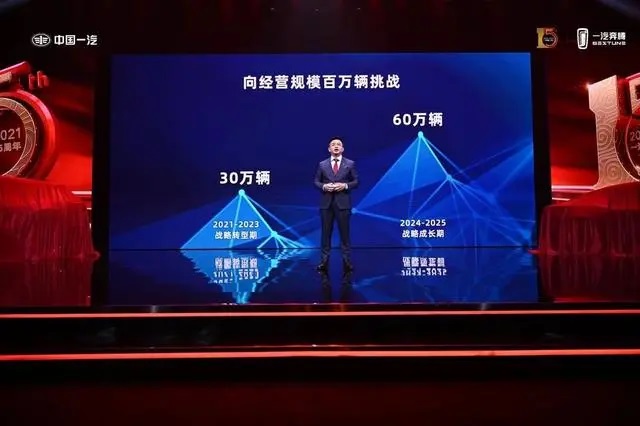

In 2021, during its 15th anniversary celebration, Bestune announced plans to achieve a strategic transformation of the brand by 2023, with a target of 300,000 units in production and sales. From 2024 to 2025, the brand aimed to launch more than two new models annually, completing a lineup of eight traditional energy vehicles and five new energy vehicles, with a target of 600,000 units in production and sales. In addition, Bestune aimed to challenge the milestone of 1 million annual sales by expanding in both the passenger car and commercial vehicle markets.

However, the lack of strong products to support these sales targets proved challenging. In 2022, Bestune's annual sales were 57,800 units, a decrease of 21.89% from the previous year. In 2023, Bestune's annual sales reached over 120,000 units, a year-on-year increase of 59.4%, marking the highest growth rate in eight years and returning to the 100,000-unit scale for the first time in three years.

Bestune's significant sales growth can be attributed to the rapid adjustment of its business strategies, with strong efforts in three major markets: private consumers, mobility and overseas. However, despite the improvement in sales, several challenges remain. First, Bestune lacks classic best-selling models to sustain its sales. Second, Bestune’s brand strength is weak due to the influence of the Hongqi brand and years of declining sales.

In 2024, FAW has publicly committed to reach 900,000 units in sales of its independent brands, with the goal of reaching 1 million units. The combined sales of Hongqi, Bestune and Jiefang brands were about 732,300 units in 2023, so to reach 900,000 units in 2024 would require a 23% year-on-year increase. To get 1 million units, a 37% year-on-year increase would be necessary.

Currently, FAW Jiefang has announced a sales target of 350,000 units in 2024. This means that the Hongqi and Bestune brands should contribute 550,000 to 650,000 units of sales. Given that the combined sales of Hongqi and Bestune were 490,700 units in 2023, where will the additional 50,000 to 150,000 units come from? Looking at current developments in various market segments, new energy vehicles are likely to play a key role in this growth.

ALL-IN New Energy Vehicles

As part of its 2024 strategic goals, FAW has set an ambitious target of selling 500,000 new energy vehicles, nearly doubling the 2023 figure of 240,400 units. This significant increase is not only a critical factor in achieving FAW's "90,000 to 1,000,000" target for its independent brands, but also a key commitment to the transition to new energy vehicles.

To this end, FAW has implemented a comprehensive strategy involving adjustments and upgrades in various aspects, including strategy, products, technology, industrial chain, and so on.

In terms of new energy strategy, in early 2023, FAW announced its commitment to fully transition to new energy vehicles and implement the following strategies - all future technological innovation and new production capacity will be used for new energy vehicles, and there will be no new investment in traditional fuel vehicle technology or production capacity.

In FAW’s strategic transition to ALL-IN NEV, the Hongqi brand is a key participant.

Photo credit: Hongqi

On January 8, 2023, the Hongqi brand unveiled its new energy vehicle brand structure, brand logo, design language, technology platform and product planning. In April, Hongqi further upgraded its brand structure and established three sub-brands: the Golden Sunflower Brand, the Energy Saving Vehicle Brand and the New Energy Vehicle Brand at the Shanghai Auto Show, consolidating its strategic direction of new energy vehicles.

Under the Golden Sunflower Brand, Hongqi has introduced models such as GUOLI, GUOYA, GUOYAO and GUOYUE. Under the Energy Saving Vehicle Brand, Hongqi showcased new H9, HQ9, HS7, HS5, HS3, H5, H6 and other models. Under the New Energy Vehicle Brand, Hongqi showcased its latest developed electric vehicle models, including EHS9, EHS7, EH7, E-QM5 and so on.

With the ALL-IN NEV strategy, FAW started to strengthen Hongqi's marketing management system in September 2023, integrating some institutions and functions of the Marketing Innovation Institute, the Marketing Center and the New Energy Vehicle Marketing Center into a new unified marketing center. After these changes, the Hongqi brand sold 370,000 vehicles in 2023, of which the retail sales of new energy vehicles reached 85,000 units, an increase of 135% year on year, and the penetration rate of new energy vehicles was about 23%.

In terms of technology, FAW's ALL-IN NEV is supported by three key pillars: pure electric, hybrid and intelligent technologies. The high-end electric and intelligent super-architecture FMEs incorporates major breakthroughs and latest achievements from FAW Group's eight technology clusters and 115 key technology areas. This architecture is mainly composed of three technical platforms, namely Hongqi pure electric platform HME, Hongqi hybrid platform HMP and Hongqi intelligent platform HIS, which are characterized by "green intelligence, safety and efficiency, extreme experience and flexibility".

Photo credit: Gasgoo

In March 2024, the Hongqi EH7, a large pure electric sedan based on FMEs architecture, was officially launched with five models priced between 229,800 and 309,800 yuan. As the first pure electric sedan launched under the Hongqi New Energy Vehicle brand, the EH7 is seen as the beginning of a new era of electrification for Hongqi and even the entire FAW Group.

In terms of industry ecosystem construction, FAW has built a green and intelligent vehicle industry ecosystem, which takes the new energy intelligent automobile industry chain as the core chain, and integrates the "five chains" including the new consumption chain, intelligent and green transportation chain, intelligent energy chain, and new infrastructure chain.

FAW has already established battery joint ventures with CATL and BYD respectively, with the joint ventures "CATL-FAW Power Battery Co. (CFBC)" now supplying batteries for vehicles and "FAW Findreams" starting production in February this year. FAW is also implementing a project in Jilin Province, which has put into operation over 20,000 Hongqi E-QM5 battery swapping vehicles and built and operated over 100 battery swapping stations.

In May 2024, FAW and NIO signed a strategic cooperation framework agreement. Under the agreement, the two parties will carry out comprehensive and in-depth cooperation in areas such as the standards of battery technology, research and development of vehicle models with swappable and rechargeable batteries, battery assets management and operations and so on.

From 2023 and 2025, FAW plans to launch a total of 30 new energy vehicle products and 24 from its independent brands. In the passenger car market, the Hongqi brand will launch 8 new energy vehicle products and the Bestune brand will launch 6 new energy vehicle products. In the commercial vehicle market, the Jiefang brand will launch 10 new energy vehicle products.

In August 2023, Qiu Xiandong, chairman of FAW, said, "In 2025, FAW NEV sales will exceed 1.45 million units, with more than 50% coming from its independent brands." If achieved, this would represent a nearly threefold increase in FAW NEV sales from the 2024 target of 500,000 units. To achieve this goal, FAW plans to expand its product lineups and market presence.

To accelerate the development of NEVs, FAW has begun to actively expand southward in China.

In February 2024, FAW Group acquired the production qualification of GUOXIN New Energy and established its Yancheng company. FAW Yancheng company used the land and facilities of GUOXIN New Energy's second plant to build a project with an annual production capacity of 70,000 pure electric passenger vehicles. This project has become the main production base for Bestune's new energy models and is regarded as FAW's first step out of Northeast China.

On May 17, FAW's Yancheng company held a ceremony to launch the production and mass production of the first car, where the first model, Bestune Xiaoma, rolled off the production line. As FAW Bestune's first strategic model in its NEV transformation, Bestune Xiaoma carries high expectations.

According to Gasgoo Auto Research Institute, in the first quarter of this year, China’s mini pure electric vehicle cumulative retail sales reached 130,000 units, Wuling Hongguang MINIEV, Changan Lumin and Geely Panda’s sales exceeded 20,000 units. Bestune Xiaoma will compete directly with these products.

According to official sources, FAW Yancheng company will produce several key NEV models under the Bestune brand. The company will invest and transform 30 production lines to reach an annual production capacity of 100,000 units by the end of this year and more than 150,000 units by the end of 2025. Meanwhile, Bestune plans to launch 7 new NEV models, covering BEV, PHEV, REEV, etc.

In addition to the Yancheng production base, FAW has also signed strategic cooperation agreements with the Shenzhen Municipal Government and the Guangdong Provincial Government to further expand its ecosystem and production capacity.

On November 28, 2023, FAW signed an agreement with the Shenzhen Municipal Government to cooperate in key areas such as forward-looking R&D, overseas automotive expansion and ecosystem construction, with the aim of building a new generation of world-class automotive cities and enterprises.

The next day, FAW and the Guangdong provincial government signed a strategic cooperation agreement, agreeing to cooperate in areas such as automotive industry innovation, production, marketing and social services, and to jointly promote the construction of the Guangdong-Hong Kong-Macau Greater Bay Area.

Although the specific details of these agreements were not disclosed, FAW's proactive expansion into southern China demonstrates its determination to succeed in the NEV market and is a critical act toward its 500,000-unit goal.

Expanding Globally to Create New Growth Opportunities

As the pioneer of China's automotive industry, FAW not only laid the foundation for China's automotive industry, but also took the first step to expand Chinese automobiles overseas.

On October 17, 1957, Jordan Overseas Trading Company ordered three Jiefang CA10 trucks from FAW at the Second China Export Commodities Fair, marking China's first automobile export.

FAW officially started its overseas market expansion in 1984, and has since experienced 40 years. At present, FAW's international business covers the export of independent brands’ complete vehicles, parts, related production and maintenance service equipment, and the revenue from international business has remained stable at more than 30 billion yuan in recent years.

In terms of complete vehicles, FAW has established a brand matrix in overseas markets, led by its Hongqi, Bestune and Jiefang brands, covering all series of independent brand products, including medium vehicle, heavy vehicle, light vehicle, mini vehicle, sedan, bus and coach.

In 2023, FAW Hongqi exported 12,800 units, a year-on-year increase of 151%, exceeding the initial target of 12,500 units. In April 2024, Hongqi set the overseas sales target at 27,800 units, doubling the 2023 figure.

With the rapid growth of sales, the Hongqi brand has expanded its overseas business, and its network now covers 28 countries and regions worldwide. Hongqi has also successfully built a "1+3+2" overseas spare parts warehouse layout, and achieved the first assembly of Hongqi vehicles outside China in cooperation with partners in Kazakhstan and Belarus, marking a significant step toward "overseas production, overseas sales".

Photo credit: Hongqi

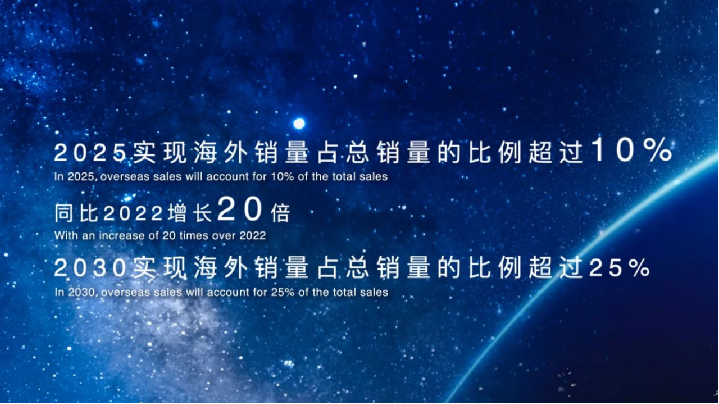

According to the plan, the Hongqi brand aims for overseas sales to account for more than 10 percent of its total sales by 2025 and more than 25 percent by 2030.

In recent years, FAW has continuously promoted technological innovation and achieved breakthroughs in several key technologies, such as high-efficiency and high-speed electric drives, intelligent drive-by-wire chassis, intelligent driving and so on. With the support of technology, FAW's Jiefang, Hongqi and Bestune brands have received continuous orders from overseas markets.

For example, FAW Jiefang signed an export order of 1,000 vehicles with its Kenyan dealer TAM in Nairobi, the capital of Kenya; the latest batch of Hongqi vehicles was successfully shipped from Dalian Automotive Terminal and exported to the Middle East. FAW Jilin signed another international cooperation order and planned to export 12,000 complete vehicles to Uzbekistan.

Photo credit: Hongqi

In June 2024, China FAW Group Import and Export Co. signed an authorized sales agreement with Norwegian Motor Gruppen Group in Drammen, Norway, and the Hongqi brand authorized the partner to sell EH7 and EHS7 in Norway, marking a breakthrough in the Norwegian market. To date, the Hongqi brand has established a sales network of 82 outlets in European countries, including Switzerland, Denmark, Iceland, the Netherlands and so on.

As one of the first Chinese automakers to go global, FAW has attached equal strategic importance to overseas and domestic markets in recent years, adhering to a "two-pronged approach" to continuously improve its international business. By the end of 2023, FAW's overseas business had covered 89 countries and regions in Europe, Africa, Southeast Asia, the Middle East, Latin America, etc., and more than 150 overseas dealers. FAW has also established four overseas subsidiaries in Eastern Europe, South Africa, Tanzania and other regions, with a total of 478 employees, and 21 KD production bases in countries such as South Africa and Tanzania.

In its international expansion, FAW has also emphasized the integration of R&D resources. In order to adapt and apply the latest global technologies, FAW has established overseas R&D centers and subsidiaries in countries such as Germany, Austria, South Africa, Russia and Tanzania.

At the beginning of this year, FAW Group set a target of "achieving overseas sales of 158,000 units, with overseas sales of independent brands reaching 128,000 units". In the first quarter, FAW Group's export sales reached 26,800 units, an increase of 79% year on year. However, given recent events such as the EU's anti-subsidy tariffs on Chinese electric vehicles, FAW's future export performance may face uncertainties.

As various parties suggested that China's automotive export strategy should gradually shift from traditional product trade exports to the establishment of a complete industry chain of products, technology, management, etc., FAW Hongqi had already mentioned in its 2023 Hongqi 2025 Overseas Plan that "in the next three years, Hongqi will launch six NEV and five energy-saving models for overseas markets. While promoting overseas sales, the brand will also establish a local presence by localizing the entire value chain, including R&D, procurement, production and sales. This approach will provide better, more economical products tailored to local needs and lay the foundation for the brand's long-term development.

FAW Jiefang said in an institutional survey that the company would base itself on reality, utilize its systematic advantages, cooperate across systems to expand globally, and build an overseas marketing platform that integrates "talent, services, vehicles, and finance".

At the same time, FAW's overseas business unit has advertised several overseas market-related positions, with job descriptions mentioning tasks such as "organizing and planning overseas plant construction". Faced with future uncertainties, FAW, which has fully participated in and witnessed the development of China's automotive industry, already has its answers.

联系邮箱:info@gasgoo.com

求职应聘:021-39197800-8035

简历投递:zhaopin@gasgoo.com

客服微信:gasgoo12 (豆豆)

新闻热线:021-39586122

商务合作:021-39586681

市场合作:021-39197800-8032

研究院项目咨询:021-39197921