Hi, everyone! Welcome to Gasgoo. In this episode of “Wheels of Change: Stories of Chinese Auto Giants,” let’s delve into the transition journey of Great Wall Motor.

A Challenging Path to the Premium Market

Among Chinese automakers, Great Wall Motor hasn't tried to enter the premium market for a very long time.

The HAVAL brand launched the HAVAL H8 and HAVAL H9 in late 2014 and early 2015 respectively, aiming to break into the premium market. However, the end market results were disappointing.

Taking the HAVAL H8 as an example, it could be regarded as Great Wall Motor’s first SUV targeting the mid-to-high-end market segment. It was highly anticipated by the company and seen as a promising model from a Chinese automaker at a time when many Chinese automakers were trying to enter the premium market.

Shortly after its launch, Great Wall Motor announced plans for comprehensive improvements and adjustments to the HAVAL H8. After its second re-launch, Great Wall Motor later announced delays in deliveries, indicating a challenging road ahead for the model.

Then Wei Jianjun decided to use his surname Wey as a brand. During the Guangzhou International Automobile Exhibition in 2016, he officially launched the high-end SUV brand - WEY, confidently stating, “I never considered failure in doing so; sealing off my retreat is the only way to succeed.”

The WEY brand launched the first model VV7 in April 2017 and the second model VV5 in August 2017. With these two models, WEY achieved nearly 90,000 units in annual sales in less than a year in 2017.

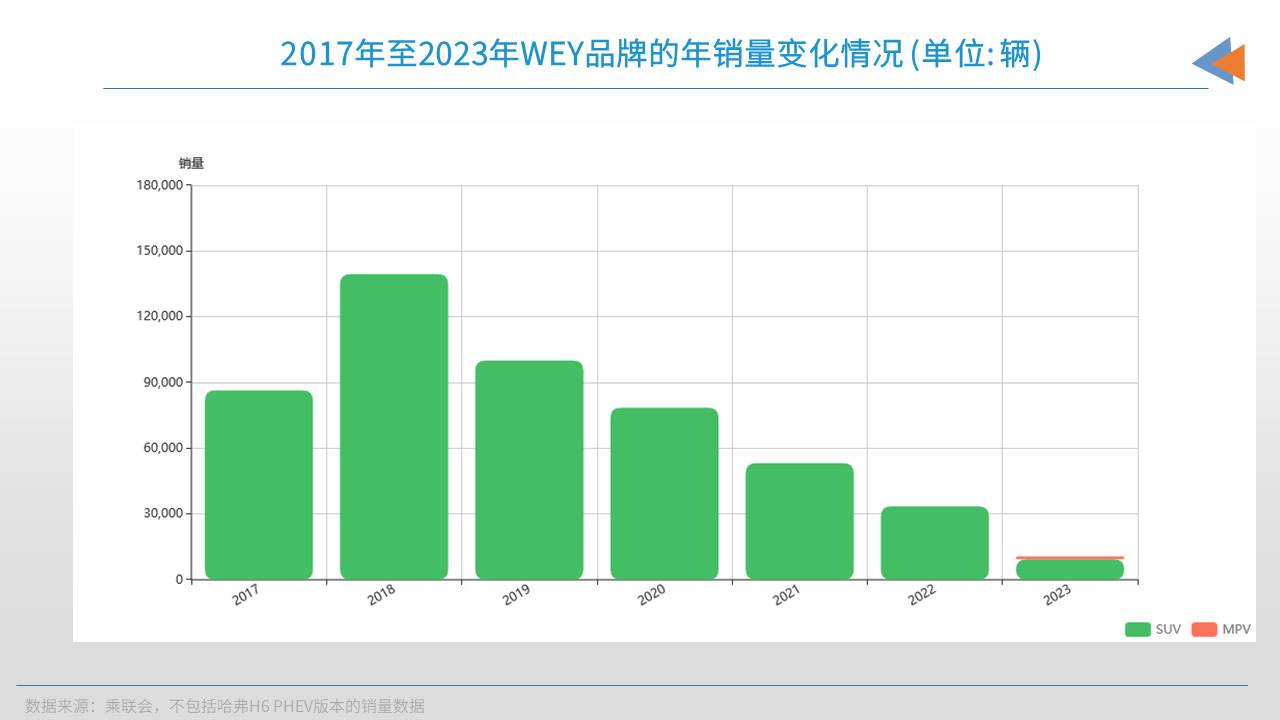

In 2018, WEY launched the VV6 and P8 models, and its annual sales exceeded 130,000 units. However, the brand’s sales declined sharply in the following years. In 2021, WEY changed the naming strategy of the models and relaunched them as the “Coffee” series, but the brand still couldn’t stop the declining sales. By 2023, the brand’s annual sales were only 10,664 units.

The WEY brand's annal sales from 2017 to 2023

The WEY Coffee Series had a clear goal: to mark a new starting point for the brand. The first model introduced was a mid-size SUV called Coffee 01, the highest-positioned model of the three Coffee Series models. Launching Coffee 01 first was intended to communicate that WEY’s brand positioning in the mid-to-high-end segment had not changed.

However, the results were not as expected. Even during the peak performance period of WEY Coffee 01, monthly sales hovered around 5,000 units, but this peak was short-lived and did not occur until the second half of 2021.

Currently, WEY’s focus has shifted to the higher positioned “Shan” Series models. However, based on the market reception, Lanshan and Gaoshan have not yet reached a level that can support the brand’s move to the premium market. For Gaoshan, in the first four months of 2024, only one month’s sales exceeded one thousand units. Lanshan’s performance is slightly better, but its monthly sales have also remained around 2,000 units.

Lanshan, Photo credit: Great Wall Motor

What really supports Great Wall Motor’s move towards high-end vehicles is the TANK brand.

Since the launch of the TANK 300, Great Wall Motor has effectively opened a new frontier for Chinese brands in the off-road vehicle market. The TANK 300 achieved annual sales of more than 80,000 units in 2021 and more than 100,000 units in 2022 and 2023. As of now, the TANK 300 has been on the market for three years, with cumulative sales exceeding 280,000 units.

What did the TANK 300 get right? The answer was its combination of aesthetic design and cost-effectiveness.

Apart from being visually appealing, the TANK 300 strikes a good balance between off-road performance and cost-effectiveness for off-road enthusiasts in China. With a price starting at just over 200,000 yuan, buyers can enjoy features like the three-lock system, the crawl mode, and the Tank Turn function.

The TANK 300 has successfully captured consumer enthusiasm with its value for money. Its arrival in the Chinese market has shattered the conventional perception of hardcore off-road vehicles as high-threshold and niche-oriented.

In line with the new trend of new energy vehicle consumption, the TANK brand has also fully embraced electrification in 2023 and initiated a new venture into the field of “off-road + new energy vehicle”. The TANK brand has launched several mid-to-high-end new energy vehicles based on the off-road hybrid architecture Hi4-T, including the TANK 400 Hi4-T, TANK 500 Hi4-T and TANK 700 Hi4-T.

700 Hi4-T, Photo credit: Great Wall Motor

The Tank 300 has established a solid market foundation and brand reputation, while the new energy off-road vehicles like the TANK 400 Hi4-T and 500 Hi4-T have also gained widespread recognition.

When the TANK 700 Hi4-T was launched, Great Wall Motor had already declared its ambition to build Chinese luxury vehicles. Priced in the range of 700,000 yuan, with the base version exceeding 400,000 yuan, the model firmly positioned itself as a high-end vehicle produced by Chinese automakers, driving the hot sales of “boxy cars” in the Chinese market.

At present, more and more Chinese brands such as YANGWANG, Dongfeng Mengshi and others are entering the luxury off-road new energy vehicle market. Whether the TANK 700 Hi4-T can help Great Wall Motor stand firm in the high-end market remains to be further tested by the market.

Moreover, the TANK 700 Hi4-T is not only aimed at the Chinese high-end vehicle market, but also has a global reach. This was clearly emphasized by the officials during the vehicle launch event: “We are aiming for a global deployment, and the off-road category is inherently global; otherwise, the market scale cannot support the high development costs.”

The TANK 700 Hi4-T launch event was also attended by many overseas media, sending a clear signal that Great Wall Motor is going global. Indeed, the pursuit of global success is the ultimate dream of Great Wall Motor.

Overseas Market is Important

As early as 1997, Great Wall Motor exported its pickup trucks to the Middle East, making it one of the earliest Chinese automakers to enter international markets. In 2005, Great Wall Motor started to develop its overseas KD assembly business, and then the HAVAL brand exported its vehicles to Italy, pioneering the mass export of Chinese automotive brands to the EU market.

In 2014, Great Wall Motor established the Tula plant in Russia. In June 2019, the Tula plant officially began production, and Russian President Putin even signed his name on the first mass-produced model from the plant, the HAVAL F7, in commemoration.

The construction of the Tula plant marked a milestone and ushered in a new phase of Great Wall Motor’s overseas strategy, with comprehensive upgrades in localized production for overseas markets. In 2016, Great Wall Motor also invested in its first overseas R&D center in Japan, initiating the integration of global resources to enhance its brand value on the global stage.

At present, Great Wall Motor’s overseas sales channels have reached 1,000, with sales to over 170 countries and regions in Europe, Australia, Africa, Central and South America, Southeast Asia and the Middle East.

Previously, Great Wall Motor mainly exported traditional SUVs and pickup trucks. Since 2022, the company has begun exporting new energy vehicles to Europe and Southeast Asia, and new energy models such as HAVAL H6, TANK 500, ORA Good Cat and WEY Coffee 01 PHEV are rapidly expanding the company’s presence in the overseas market. Data shows that in 2023, Great Wall Motor’s overseas sales exceeded 300,000 units for the first time.

Great Wall Motor has its own distinctive Chinese market layout and has forged its own path in overseas markets. The key element of the company’s overseas strategy is its commitment to localization.

Currently, Great Wall Motor has set up overseas R&D centers in the United States, Germany, Japan, Canada, South Korea, Austria and India, among other locations. The company has established three overseas full-process factories in Russia, Thailand and Brazil and several KD factories in Ecuador, Pakistan and other places, which can respectively serve regional markets such as Eastern Europe, Central Asia, ASEAN and Latin America.

Photo credit: Great Wall Motor

In 2023, Great Wall Motor held an Investor Day to showcase its comprehensive capabilities in overseas industrial chain layout and system construction. The company aimed to chart a new course for international expansion through an “ecosystem going global” strategy, combining vehicle manufacturing with supply chain systems.

This strategy not only promotes vehicle exports, but also integrates the production system into global markets, creating an integrated ecosystem of research, production and sales. Leveraging China's competitive advantages in electrification and intelligent automotive technologies, Great Wall Motor plans to expand and win in global markets through its “ecosystem going global” strategy, which will be a key focus in the next phase of the company's development.

The Forest Ecosystem

In the development of ecological capacity, Great Wall Motor has experienced many twists and turns, especially in areas such as the transition to new energy vehicles and the entry into high-end markets. However, the company has gradually built its own “forest ecosystem,” the layout of the entire industry chain in terms of pure electric, hybrid, and hydrogen energy.

Photo credit: Great Wall Motor

In terms of batteries, Great Wall Motor has laid out batteries for multiple chemical systems, including LFP, cobalt-free, ternary and solid-state batteries. The company has also released the Dayu battery technology.

In electric powertrain systems, Great Wall Motor has also built two major platforms, M and L, and has a series of products ranging from 100 kW to 220 kW, covering A to D-class commercial vehicle models.

In terms of hybrid technology, Great Wall Motor has developed the L.E.M.O.N Hybrid DHT Technology platform, 9HDCT (the 9-speed wet-type dual-clutch transmission), and 9HAT (the 9-speed hydraulic automatic transmission with P2 hybrid layout) based on the TANK PLATFORM.

In March 2023, Great Wall Motor also unveiled its latest intelligent 4WD electric hybrid technology - Hi4. The company used the innovative configuration of dual-motor series-parallel electric four-wheel drive on the front and rear axles, achieving “optimal efficiency in all operating conditions and worry-free driving in all scenarios.”

In terms of hydrogen energy, Great Wall Motor has developed an internationally leading vehicle-grade hydrogen power system, Hydrogen Lemon Technology, covering hydrogen fuel cell systems, on-board hydrogen storage systems and key core components. With hydrogen energy as the main body, the company has built an integrated industrial chain development model of “production-storage-transportation-process-application”.

In terms of automotive grade IGBT and SiC, Great Wall Motor has deeply laid out and established Xindong Semiconductor. Xindong Semiconductor has independently developed and put into mass production of IGBT by the end of last year. In the future, Xindong Semiconductor aims to achieve 3.6 million power modules by 2028, gradually reducing the dependence on overseas supply chains that currently constrain Chinese automakers.

In the field of steer-by-wire technology, Exquisite Atuo’s intelligent steer-by-wire chassis can be seen as pioneering in a blank space in the Chinese market. With the support of this system, Great Wall Motor has previously stated that the penetration rate of its high-level autonomous driving front-loading will reach 40% by 2025.

In the field of intelligent driving, HAOMO.AI, an autonomous driving technology start-up backed by Great Wall Motor, has become a leading company in its segment. As of February 2024, HAOMO.AI’s passenger vehicle intelligent driving system, HPilot, has been equipped in over 20 vehicle models, with assisted driving covering more than 120 million kilometers, according to the company’s official data.

According to Gasgoo Automotive Research Institute, under the “forest ecosystem”, Great Wall Motor has built a comprehensive industrial ecosystem covering intelligent, electric and traditional components, centered around its five major automotive brands and based on the COFFEE INTELLIGENCE, L.E.M.O.N. PLATFORM and TANK PLATFORM.

Photo credit: Great Wall Motor

From a technological perspective, Great Wall Motor has laid out several initiatives in technology including steer-by-wire braking, CTC, integrated die-cast aluminum body, urban NOH, Coffee OS, autonomous driving data intelligence system “MANA,” AI data center “MANA OASIS,” and automatic driving cognitive model DriveGPT. The enterprises backed by Great Wall Motor include HAOMO.AI, BeanTech and Exquisite Atuo.

In the field of new energy vehicle technologies, Great Wall Motor has developed various products including SiC, L.E.M.O.N. DHT, electric drives, batteries, hydrogen storage systems, hydrogen fuel cell engines and cadmium telluride photovoltaics. The enterprises backed by Great Wall Motor include SVOLT, HYCET, FTXT, UtmoLight and Xindong Semiconductor.

In terms of traditional components, NOBO AUTOMOTIVE SYSTEMS, MIND and other companies backed by Great Wall Motor have also been the leading companies in their respective segments in terms of seats and lamps.

It is clear that the forest ecosystem has not only enhanced Great Wall Motor’s capabilities in technological innovation and the mass production of high-tech products but also integrated the internal and external industrial chains. This will lay the foundation for Great Wall Motor to address future market challenges.

In addition, Great Wall Motor’s management system has undergone a great transformation and has been in line with Huawei's modern management principles that were highly regarded by large enterprises. Currently, Great Wall Motor is accelerating the global restructuring of its management system with a focus on “process and digital transformation,” and is rapidly building a user-centric research, production, sales and service system.

Especially in recent years, after introducing unconventional naming strategies such as the “Dog” series, “Cat” series and others, Great Wall Motor has increasingly focused its marketing efforts on younger consumers. The company has achieved continuous brand exposure through a series of low-cost operations.

Wei Jianjun's previous attempts at live broadcasts were also an innovative marketing approach, showcasing Great Wall Motor's accumulated technology in autonomous driving directly to a wide audience of netizens. It was also a typical case of achieving significant impact with low-cost operations.

The change in marketing style was just a glimpse of Great Wall Motor’s strategy to rejuvenate its brand. A more profound change was reflected in the company’s organizational structure. Great Wall Motor has seen the departure of several senior executives and is gradually breaking down barriers based on seniority and boldly embracing new talent. A large number of post-80s and post-90s young people have entered the core circle of power within Great Wall Motor and have increasingly demonstrated their innovation and decision-making capabilities.

After decades of development, Great Wall Motor has grown from an automotive manufacturing factory to a large automotive group with nearly 90,000 employees, more than 90 holding subsidiaries, a market value of over 100 billion yuan, and an annual R&D investment of over 10 billion yuan.

Throughout the process, Great Wall Motor has experienced many trials and errors and has also developed its unique characteristics. Ultimately, the company has created an energy-intelligence-oriented forest ecosystem, established the parallel development of hybrid, pure electric and hydrogen energy, and carried out the layout of the entire industry chain in terms of intelligent driving, intelligent cockpit and intelligent chassis, and built an industry-leading energy system of “photovoltaic + distributed energy storage + centralized energy storage” has completed the full value chain layout of “solar energy-battery-hydrogen-vehicle power”.

Three years ago, on the eve of its 30th anniversary, Great Wall Motor released a letter from Wei Jianjun and proposed the goal of transforming itself into a global mobility technology company.

Today, in the midst of electrification, Great Wall Motor is still playing catch-up. However, in line with Wei Jianjun’s unwavering commitment, he believes that a successful automaker must adhere to long-termism. Perseverance and leadership in the sprint phase will determine the true winners. Great Wall Motor is striving towards this direction.

联系邮箱:info@gasgoo.com

求职应聘:021-39197800-8035

简历投递:zhaopin@gasgoo.com

客服微信:gasgoo12 (豆豆)

新闻热线:021-39586122

商务合作:021-39586681

市场合作:021-39197800-8032

研究院项目咨询:021-39197921