Hi, welcome to Gasgoo. In this episode of “Wheels of Change: Stories of Chinese Auto Giants,” let’s talk about NIO.

NIO's New Brand "ONVO" Targets 200,000 Yuan Market

On the evening of May 15, NIO's second brand, ONVO, was officially launched. On that day, the ONVO L60, the first car, was unveiled with a pre-sale price starting at 219,900 yuan and would be delivered in September.

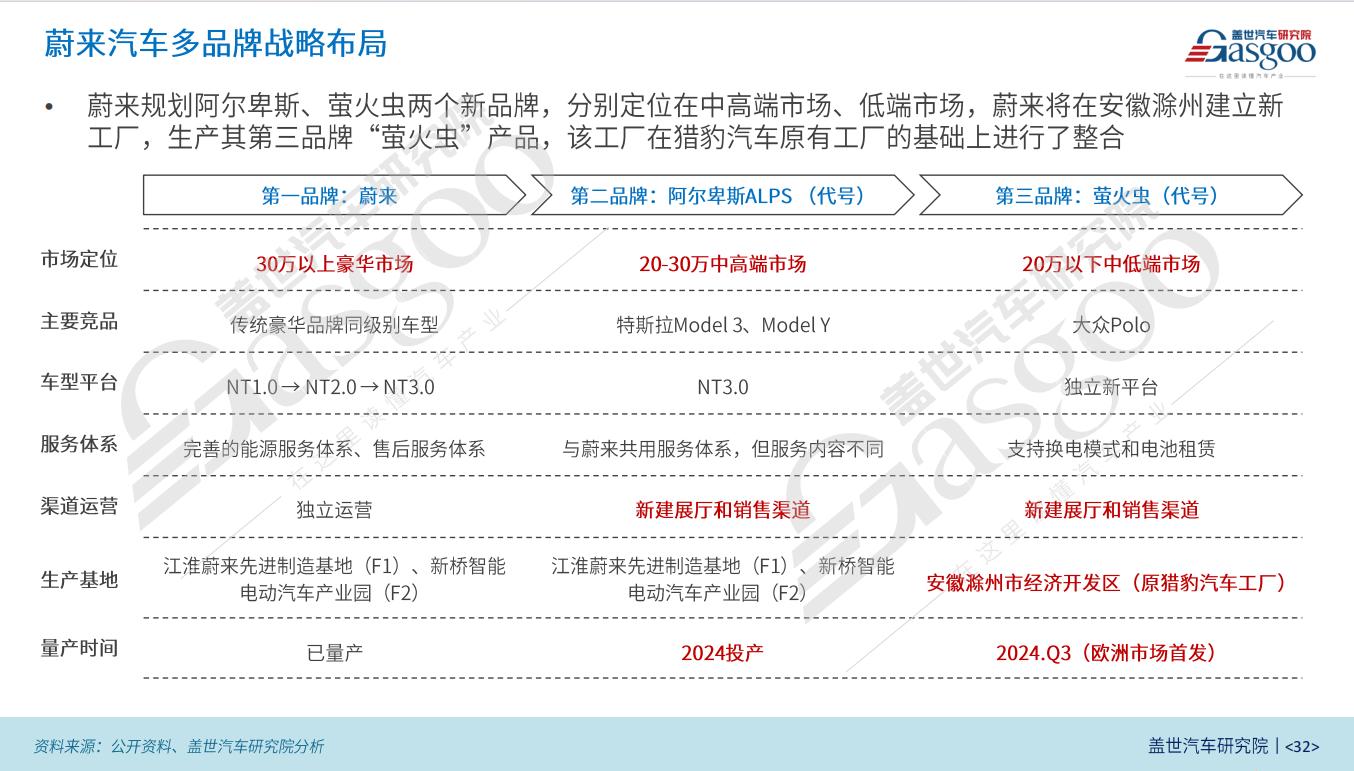

As a key part of NIO's multi-brand strategy, NIO has high expectations for the ONVO brand. The brand is seen as a crucial step for NIO to enter the 200,000 yuan family car market, with the important mission of driving volume and profitability.

As NIO's first sub-brand, ONVO has been the subject of much speculation. As early as 2021, NIO assembled a team for the second brand, codenamed "Alps". The brand initially planned three models, targeting a price range below 300,000 yuan.

ONVO made no secret of its ambition. The ONVO L60 was positioned directly against the Tesla Model Y. At the launch event, ONVO executive Ai Tiecheng used various methods to thoroughly contrast the ONVO L60 with the Model Y.

"Our strategy is to start with the high-end market," said Li Bin. "But after that, NIO still needs to serve a broader user base."

ONVO will establish its own sales network, and use part of NIO's after-sales service system and NIO's battery swapping network. It is reported that ONVO aims to establish at least 200 sales outlets in 2024. NIO will provide talent and training for ONVO's sales teams. However, due to differences in positioning and target customers, ONVO will have a different store location strategy.

Whether low-cost products can be profitable depends on the automaker's supply chain management capabilities and whether it can achieve greater market scale. As the first Chinese NEV startup to launch a sub-brand, NIO has a clear positioning for ONVO: penetrate the mass market, focus on sales volume rather than profit margins. NIO emphasizes that ONVO is not a low- or mid-end brand, but rather targets a broader mass market.

In addition to ONVO, NIO has a third brand codenamed "Firefly" that is expected to be launched in 2025. According to reports, this new brand is likely to be priced between 100,000 and 200,000 yuan, featuring a purely vision-based autonomous driving solution with low hardware costs, and is likely to be aimed mainly at overseas markets.

NIO's Global Strategy Bets on Timing

In May 2021, NIO released its Norway strategy, marking the company's official entry into the Norwegian market and the first step in its global expansion.

In October 2022, NIO hosted the “NIO Berlin 2022” event to introduce the ET7, EL7 and ET5 to the European market, including Norway, Germany, the Netherlands, Denmark and Sweden. NIO offers its products in Europe through direct sales, leasing programs and the innovative NIO Subscription Service.

In December 2023, NIO entered into a share subscription agreement with CYVN Holdings. CYVN would invest an aggregate of US$2.2 billion in cash. CYVN would help NIO pursue product innovation, technological breakthroughs and international market expansion.

In February 2024, AUTO BILD, a well-known German automotive magazine, announced the results of its "Best Imported Car 2023" awards. The ET7, NIO's flagship intelligent electric sedan, won in the upper class car category.

NIO continues its global expansion in 2024. NIO recently officially opened its largest European NIO House in Amsterdam, the Netherlands, and the Smart Driving Technology Center in Berlin in April 2024. It is the first center of its kind outside of China and is proof of the company’s international footprint.

What factors led to the decision to enter the European market? NIO believes that the European market represents the highest level of development in the automotive industry, making it a critical battleground for Chinese automakers to prove their capabilities in the global market.

Since entering the automotive market, NIO has positioned itself as a high-end luxury brand for new energy vehicles, differentiating itself from other brands in terms of price, service, battery swapping and so on. Therefore, the recognition from the European market is also a proof of its high-end positioning.

In other words, entering the European market, the home of BBA (BMW, Benz and Audi), can reinforce NIO's strong high-end brand image. From another perspective, Europe's high urbanization rate makes it an ideal market for EVs, with EV penetration second only to China. If NIO does not seize this opportunity, it may miss out on this growth wave. By establishing a foothold in the European market, NIO can secure significant incremental growth.

NIO's overseas expansion strategy involves a systematic approach. In Europe, NIO established an innovation center in Berlin in July 2022, focusing on smart cockpit, autonomous driving, and energy technology.

NIO also established the Power Europe Plant in Pest, Hungary, in 2022, serving as its European manufacturing, service, and R&D center for battery charging and swapping products. The plant produced the first battery swapping station in September 2023, advancing the deployment of NIO's charging and swapping infrastructure in Europe.

NIO has completed 20 battery swapping stations in Europe by the end of 2022 and aims to build 1,000 battery swapping stations in markets outside of China by 2025.

According to sales data released by the European Commission in 2023, the market share of Chinese electric vehicles in Europe has increased to 8%, with the potential to reach 15% by 2025.

As one of the Chinese brands entering Europe, NIO sold 2,399 vehicles in 2023, ranking fifth in car sales in 13 European countries.

In 2024, NIO will accelerate its global expansion plans while emphasizing a flexible partnership strategy. As Li Bin said, NIO will initially focus on the Chinese market, the largest and most competitive market for NIO, but will continue to explore international markets.

NIO has currently expanded to five European countries and is committed to improving operational efficiency in these markets. NIO also plans to enter new markets this year, including the United Arab Emirates.

Since its inception, NIO has faced numerous challenges, from product quality issues to financial crises, and has often been on the brink of survival. However, the company has proven resilient in overcoming these obstacles and has consistently demonstrated its ability to adapt and thrive.

As a fast-rising brand in the Chinese and global electric vehicle industry, NIO is reshaping the global automotive industry with its unique brand concept, cutting-edge technology and exceptional product performance.

联系邮箱:info@gasgoo.com

求职应聘:021-39197800-8035

简历投递:zhaopin@gasgoo.com

客服微信:gasgoo12 (豆豆)

新闻热线:021-39586122

商务合作:021-39586681

市场合作:021-39197800-8032

研究院项目咨询:021-39197921