Hi, this is Gasgoo. In this episode of "Wheels of Change: Stories of Chinese Auto Giants," let's continue our talk about the global automotive tech giant - Chery Holding Group.

Technology-driven Chery: Five Major Technologies Accelerating the Transition to Intelligence and Electrification

As one of the first Chinese automakers to develop independent technologies, and the first Chinese passenger car manufacturer to master core technologies such as engines, transmissions, chassis, and platforms, Chery has been marked by its technical prowess since its inception.

However, in the era of smart electric vehicles, Chery's progress in intelligence and electrification has not been as smooth. While top players in the industry have been showcasing their strengths in areas such as smart cockpits, autonomous driving, and battery technology, Chery seemed to remain relatively quiet.

In response, Chery made the bold decision to invest hundreds of billions to address its shortcomings and fully embrace the shift toward smart electric vehicles.

In September 2022, Chery unveiled "Yaoguang 2025" forward-looking technology strategy, covering four core technology areas: the Mars Architecture, Kunpeng Power, Lion Technology, and Galaxy Ecosystem. At the same time, Chery announced plans to invest over 100 billion RMB in five years, recruit over 20,000 R&D talents, and establish 300 Yaoguang laboratories.

In 2023, this strategy evolved into five major technology domains, with Dazhuo Intelligence joining as a key component of Chery's autonomous driving efforts under the "Yaoguang 2025" strategy.

In April 2023, Chery introduced a new new-energy strategy, announcing that under the guidance of the "Yaoguang 2025" plan, it would focus on 15 key technology tracks related to electrification and intelligence, paving the way for new development paths.

According to the new-energy strategy, Chery launched the Super Hybrid Platform under the Mars Architecture and the E0X high-performance electric platform. Supporting these platforms are 135 electric and intelligent technologies that have been or are about to be deployed, including Chery's third-generation hybrid technology, battery and electric drive technology, Chery's full-stack in-house developed CHERY-OS, Lion 6.0 smart cockpit solution, and intelligent driving technology.

In terms of electrification, Chery has made deep industrial investments and R&D efforts around core new-energy technologies.

Regarding battery technology, while Chery has long relied on suppliers like CATL and Gotion High-Tech, it hasn't given up on developing its own battery technology. Chery’s unique battery technology integrates NP2.0 and new materials like M3P, providing three major advantages: full-cycle safety, full-temperature range applications, and full-scene user experience.

Gao Xinhua, Chery’s Executive Vice President and Head of the Engineering R&D Institute, revealed in December 2023 that Chery will launch its self-developed power battery this year, which will be an important step in Chery's independent innovation in the core technology of new energy vehicles.

Complementing its battery technology, Chery's electric drive technology is also notable. Its newly developed electric drive system utilizes 800V SiC technology, achieving an efficiency of over 91% under CLTC, a peak power of 265 kW, and a torque of 5,000 N·m.

In addition, Chery has launched its new C-DM hybrid system, a crucial technology for Chery’s rapid transition to new energy over the next few years.

Chery has accumulated 18 years of experience in hybrid technology, progressing through three generations. The third-generation hybrid technology, Kunpeng Super Hybrid C-DM, includes the ACTECO 1.5TGDI engine, three-speed super hybrid DHT, continuously variable super hybrid DHT, a hybrid-specific battery, and a battery management system.

It boasts impressive performance figures, such as a thermal efficiency of over 44.5%, fuel consumption of just 4.2 liters per 100 km in charge-depleting mode, a maximum combined range of over 1,400 km, and 0-100 km/h acceleration in just 4.26 seconds.

With these technological advances, Chery boldly declared at last year's Fengyun release that "without Chery, the hybrid market is incomplete”.

Chery, which initially rose to prominence through its self-developed engines, is well within its comfort zone in developing hybrid-specific engines. Moreover, Chery has also developed a range-extended engine used in the EXEED STERRA ET, equipped with a 1.5T-GDI turbocharged engine and fourth-generation i-HEC combustion system, delivering a range of over 2,000 km.

Overall, with its comprehensive technological layout in the NEV sector, Chery has rapidly launched numerous pure electric, hybrid, and range-extended models over the past two years. Notably, fuel cell vehicles are also a key part of Chery's future strategy, and Chery has completed the development of four generations of hydrogen fuel cell vehicles.

Currently, Chery's passenger car division is pursuing a multi-pronged strategy that includes hybrid, range-extended, hydrogen, and pure electric technologies, alongside its battery, motor, and electronic control systems.

Simultaneously, Chery’s transition to intelligence is also key to its next breakthrough.

Chery began its journey into intelligent driving technology in 2010, focusing on active safety technologies. Since 2018, Chery has been working on building the core capabilities needed for intelligent vehicle development.

It has integrated internal resources and sought external technical and capital partnerships to strengthen its efforts in intelligent connectivity, autonomous driving, data operations, intelligent manufacturing and mobility services.

In 2018, Chery officially launched its intelligent brand strategy—CHERY LION. In March 2019, Chery upgraded its intelligent business into the Group’s seventh major division, with Wuhu Lion Automotive Technology Co., Ltd. serving as the operational entity.

In terms of smart cockpits, Chery implemented its intelligent connected driving system in series of Chery products in 2016 and deployed the i-Connect@ Lion 1.0 system in the Tiggo 8 and Arrizo EX in 2018. With the advancement of the Yaoguang 2025 strategy, breakthroughs have been made in areas such as LION Melody 2.0, LION AI Large Model 2.0, and LION OS, further evolving the Lion cockpit.

For intelligent driving, Dazhuo Intelligence, as an autonomous driving solutions provider and integration platform, is a key part of Chery’s smart driving strategy. Currently, Dazhuo has four product lines, including Pilot 2.0 for basic safety ADAS, Pilot 3.0 for highway NOA, Pilot 4.0 for urban NOA, and Drive 1.0 for dual-use L4 intelligent driving for both passenger and commercial vehicles.

Among them, the Pilot 2.0 system is already deployed in 36 countries and is expected to be equipped in more than 20 models by 2024. As discussions about Chinese intelligent driving technology going abroad become increasingly heated, Dazhuo Intelligence has quietly made its way overseas.

Leveraging Chery's global footprint, Dazhuo is actively expanding its presence in global markets. By 2025, the smart driving products of Dazhuo are expected to be available in over 80 countries, with the goal of reaching a production volume of one million units domestically and another million internationally by 2025.

It's worth noting that Chery’s approach to intelligent driving is not full-stack self-research, but rather full-stack control with core technologies developed in-house. By collaborating with external partners, Chery aims to accelerate the development of intelligent driving technologies while ensuring the safety and stability.

In the fields of automobile intellectualization such as intelligent driving and smart cockpits, Chery is building a full-stack controllable CHERY-OS system. This system encompasses vehicle cockpit operating system, intelligent driving operating system and vehicle control operating system, enabling Chery to rapidly iterate its intelligent systems and integrate ecosystems quickly. It is one of the key technologies for Chery to succeed in the second half of the NEV race.

It is evident that Chery's efforts in car intelligence are gaining momentum.

Currently, Chery has established a global R&D system with centers in Wuhu, Shanghai, North America, South America, Europe and Central Asia. By the end of 2023, Chery had applied for over 29,000 patents, ranking at the forefront of China’s automotive industry.

During Auto China 2024, Yin Tongyue emphasized that the soul of Chery is intelligence. Over the next five years, Chery plans to invest 20 billion RMB to accelerate the transformation toward intelligence.

As Chery accelerates its shift toward smart electric vehicles, its image is also evolving from an underestimated "techie" to "Technology-driven Chery" and is now embarking on a new journey towards becoming an "innovative high-tech enterprise".

Ecosystem Matrix: Comprehensive Industrial Layout Boosts Systemic Competitiveness

As the industrial landscape continues to evolve, each automaker is at a critical juncture, navigating between old and new paths. Today's automotive market competition extends far beyond brands or models—it's a systematic battle encompassing technology, services, capacity building, and cooperative ecosystems.

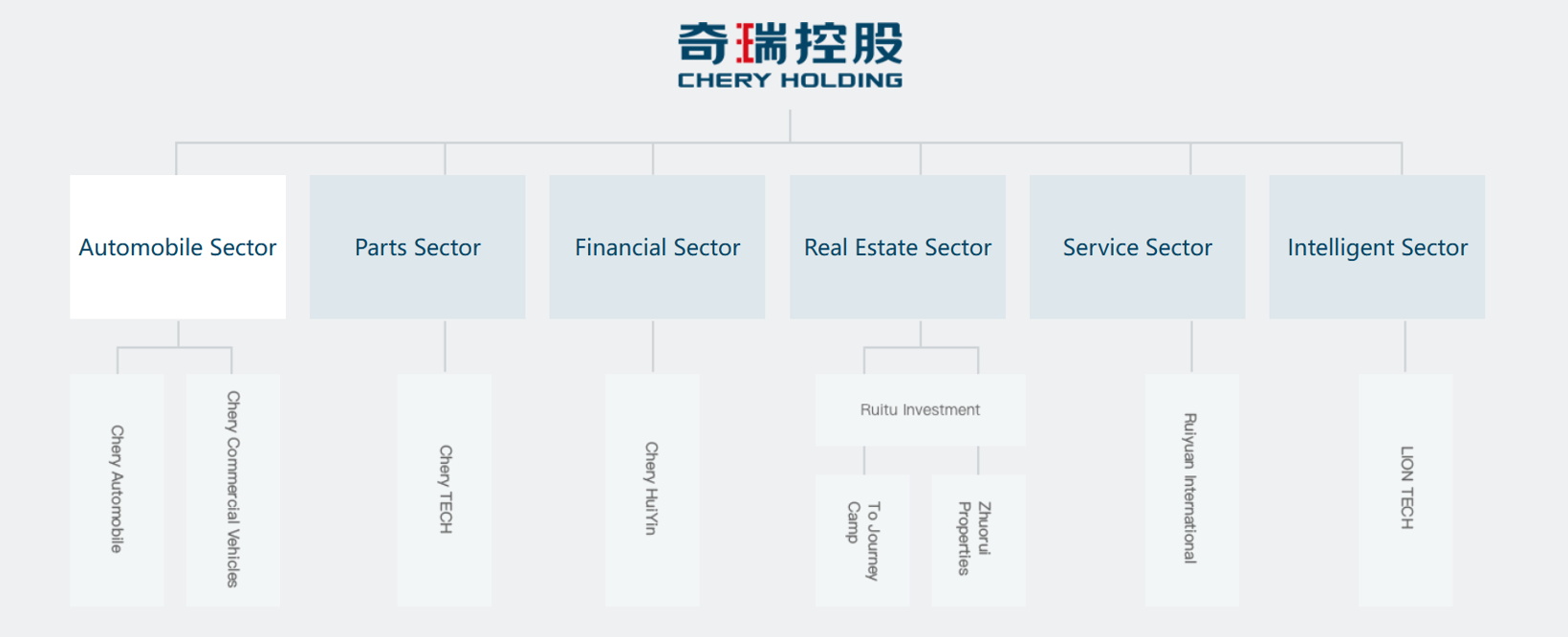

In terms of its own industrial layout, Chery entered a new phase of group-oriented development in 2010 with the establishment of Chery Holding Co., Ltd. (later renamed as Chery Holding Group Co., Ltd.).

Centered around the main automotive value chain, Chery expanded its upstream and downstream operations, evolving into a diversified conglomerate.

Currently, Chery Holding has formed seven major business segments, including automobiles, auto parts, finance, real estate, modern services, and intelligent business.

It now oversees over 300 member companies, including Chery Automobile, Chery Finance Service, and Chery Technology, with operations spanning more than 80 countries and regions worldwide.

In the auto parts sector, Chery has focused its efforts on key areas such as powertrains, electric drives, batteries, chassis, body systems, electronics, semiconductors, and software through "capital operations" and "industrial operations."

Around 2015, Chery pushed several of its strong business units to the capital market, helping three auto parts companies including Bethel, EFORT and Rayhoo Motor Dies to complete their public listings.

However, despite incubating multiple listed companies, Chery's own IPO journey has been fraught with challenges.

Since first being rumored to plan a public listing in 2004, new updates about Chery's IPO have trickled in over the past two decades. Last year, Yin Tongyue set a goal for Chery to complete its IPO by 2025.

The growing sales and strong overseas performance undoubtedly give Chery more confidence in its listing aspirations. One of the primary goals of Chery is to raise significant capital through IPO.

As of 2023, Chery Group has established production bases in several locations across China, including Kaifeng, Wuhu, Shijiazhuang, Ordos, Dalian, Yibin, Changshu, Hefei, and Guiyang. These facilities support the production of Chery's four major brands, as well as joint ventures such as Chery Jaguar Land Rover and Kaiyi.

Based on preliminary calculations, Chery's total production capacity in China has exceeded 2.8 million units. Regarding overseas capacity, Chery's official website indicates that by the end of 2020, its overseas production capacity had already reached 200,000 units annually. In total, Chery’s global production capacity has surpassed 3 million units.

Chery's total sales in 2023 reached 1.88 million units and the overall capacity utilization rate is estimated to have surpassed 80%.

For Chery, its production bases primarily cover China's eastern, northern, and southwestern regions, but there is still a lack of capacity in the southeastern coastal market.

In March of this year, Southeast Motor underwent a change in ownership, with its original parent company, Fuzhou Zuohai Holding Group Co., Ltd., exiting. Chery Automobile Co., Ltd. became its new sole shareholder.

The Fujian production base of Southeast Motor provides Chery with a promising opportunity to fill this regional capacity gap. Additionally, the ASEAN market is a key export destination for Chery, and cooperation with Southeast Motor could further enhance Chery’s reach into the ASEAN market.

Along with its ten overseas production bases, and the Argentine factory under construction and the Spanish factory that has just reached cooperation, Chery’s global production footprint continues to expand.

While Chery is steadily expanding its own industrial layout, it is also actively developing external partnerships. Suppliers like Horizon Robotics, CATL, and iFlytek have all become Chery’s key partners.

These partnerships will help drive Chery’s electrification and intelligentization strategies, potentially opening up new business opportunities and growth prospects.

Chery today is no longer struggling with sales and profitability challenges. Driven by strong sales, the company's revenue surged from 105.6 billion RMB in 2020 to over 300 billion RMB in 2023, laying a solid foundation for its push into Chinese market and addressing gaps in the NEV sector.

However, Chery still faces many unresolved challenges, with the foremost being its NEV transformation.

As other Chinese automakers such as BYD, Great Wall, Geely, and NIO launch a new wave of global expansions, Chery’s overseas sales may face increased competition. However, Chery has already gained a first-mover advantage abroad. Now, the question is whether Chery’s transformation to smart electric vehicles can keep pace with the leading players.

联系邮箱:info@gasgoo.com

客服QQ:531068497

求职应聘:021-39197800-8035

新闻热线:021-39586122

商务合作:021-39586681

市场合作:021-39197800-8032

研究院项目咨询:021-39197921

版权所有2011|未经授权禁止复制或建立镜像,否则将追究法律责任。

增值电信业务经营许可证 沪B2-2007118 沪ICP备07023350号