Hi, this is Gasgoo. In this episode of "Wheels of Change: Stories of Chinese Auto Giants," let's continue our talk about the industrial capital hunter - Zhejiang Geely Holding Group.

The Path to New Energy Vehicle Transformation

Through its aggressive acquisition strategy, Geely Holding has opened a new chapter in deepening its industrial layout and expanding its market territory. This approach has not only enriched its brand matrix but also significantly enhanced its core competitiveness, as reflected in its sales over the past few years.

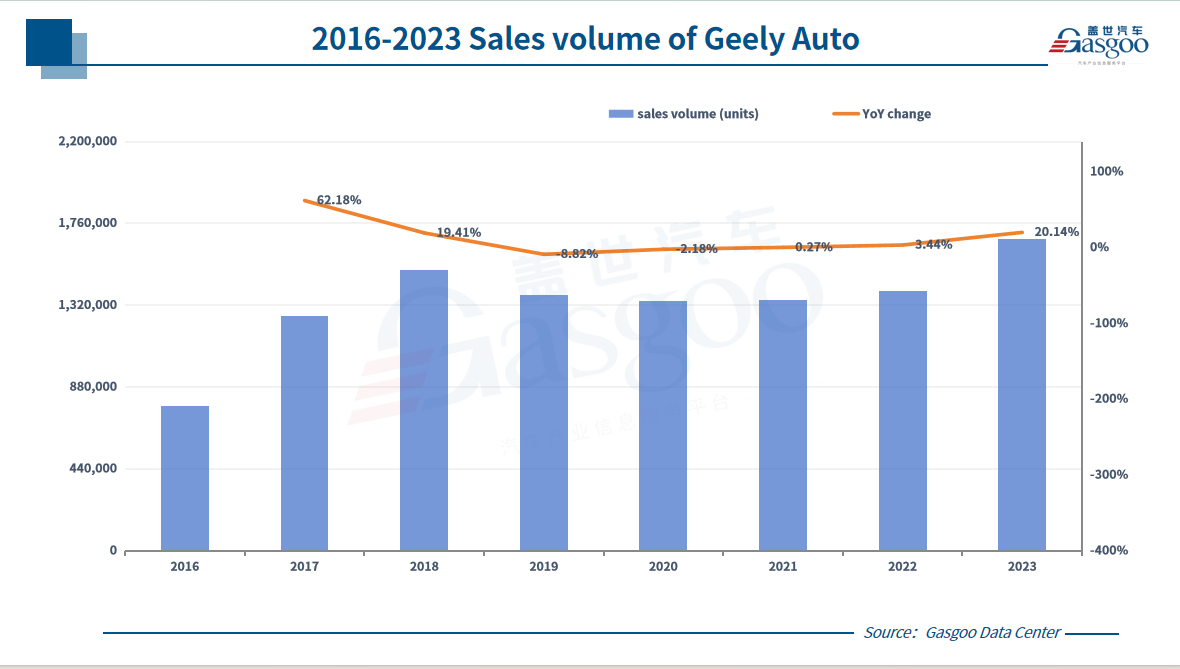

From 2014 to 2018, Geely Auto has grown by leaps and bounds, with sales soaring from 430,000 units to 1.5 million units, an increase of nearly 2.5 times.

In 2017, Geely ended the winning streak of Great Wall and surged to become the leading self-owned passenger car brand in China.

Although this performance has something to do with external policies and market conditions, it ultimately owes much to the acquisition of Volvo Cars.

By absorbing and digesting Volvo's technology, Geely Auto has successively launched competitive models such as Borui, Boyue, Emgrand GS, Emgrand GL, and Vision X3.

Among them, Boyue quickly became a best-selling SUV after its launch in 2016, with sales reaching 287,000 units in 2017. Additionally, the Lynk & Co brand, which Geely cooperates with Volvo, also began to be launched in 2017.

It was precisely because of the strong performance of Boyue, Borui, and Emgrand series, coupled with the launch of new models such as Binrui, Binyue and Lynk & Co brand, that Geely Auto achieved growth against the backdrop of the automotive market entering a downturn from 2017 to 2018.

However, after reaching a peak of over 1.5 million units in 2018, Geely's growth began to decline. This was partly due to the continuous industry downturn, but the more important reason is that Geely Auto obviously began to fall behind in the field of new energy vehicles(NEVs).

Although Geely Auto announced its entry into the NEV market as early as 2015 with the launch of the Blue Geely Initiative, aiming for NEVs to account for over 90% of its total sales by 2020, the results fell short of expectations. In 2020, Geely Auto sold only 68,000 units of NEVs, accounting for just 5% of its total sales.

Upon closer examination, the Geometry brand suffered poor sales due to its "oil-to-electric" route and focus on the B2B market.

The Polestar brand also struggled to gain traction because of its niche positioning.

At that time, Geely Auto lacked strong flagship products in the NEV sector. It wasn't until late 2021 to early 2022 that Geely's new generation of flagship products, the Zeekr brand and NordThor Hybrid, had their first mass-produced models launched.

At an internal meeting in early 2021, Li Shufu stated that Geely was formulating two Blue Geely Initiatives. One focuses on energy-saving and NEVs, 90% of which are new energy hybrid vehicles, while the other targets pure electric intelligent vehicles. For the latter, he mentioned the formation of a new pure electric vehicle company to directly compete in the market.

In the same year, Zeekr was established. Backed by the resources of the Geely Holding Group, Zeekr achieved annual sales of 70,000 units in 2022, its first full year of deliveries.

At the same time, Geely Auto entered the hybrid market by focusing on the development of its technology brand Nordthor Powertrain, and launched the modular intelligent hybrid platform - NordThor Hi·X.

In the battery swapping sector, Geely introduced the Livan Auto brand after restructuring Lifan Auto, and developed the GBRC modular platform for charging and battery swapping.

Based on the SEA, CMA, SPA, and BMA architecture platforms, as well as the NordThor Hi·X and GBRC platforms, Geely has restructured the new energy strategies for its major brands.

Lynk & Co and the Geely brand focus on the hybrid vehicle market, targeting mainstream gasoline car users transitioning to NEVs.

The Geometry brand caters to the NEV segment within the¥200,000 price range.

Zeekr targets the market above the¥300,000 price range, while Lotus aims at the ultra-luxury electric vehicle market.

Livan and Maple focus on battery swapping technology, and together with Cao Cao Mobility, are expanding into B2B market.

As a result, despite losing its title as the top domestic automaker in 2022, which it had held for five consecutive years, Geely Auto saw significant growth in NEV sector.

Its pure electric vehicle sales increased by 328% year-on-year, and its plug-in hybrid vehicle sales grew by 219%, both far exceeding the industry average growth rate.

In 2023, the Geely Galaxy series was officially launched. In less than a year, three new models—Galaxy L7, Galaxy L6, and Galaxy E8—were rapidly introduced, establishing a product lineup of pure electric and hybrid vehicles, as well as sedans and SUVs in the mainstream NEV market. Cumulative sales of this series have already surpassed 100,000 units.

According to the new plan, Geely Galaxy will target the mass market in the ¥100,000 to ¥200,000 range.

Lynk & Co will take over the mainstream segment in the¥200,000 to ¥300,000 range. Both brands will share the responsibility of driving NEV sales for Geely.

Meanwhile, Zeekr will focus on the pure electric market above ¥300,000, carrying Geely's hopes for elevating to the high-end market.

In 2023, Geely Auto did not reclaim the top spot as the leading China automaker, but Geely's NEV sales reached 487,461 units, a remarkable increase of over 48% compared to the previous year.

In January of this year, Geely Auto achieved a even better performance, not only regaining the top spot in overall car sales but also achieving a new milestone in NEV sales, reaching 65,826 units, an almost six-fold increase year-on-year, setting a record high.

Looking forward, Geely Auto is expected to continue to accelerate in NEV Sector. According to the plan of Geely Auto, it will challenge the sales target of 1.9 million vehicles in 2024, with a target growth rate of more than 12%, while NEV sales are planned to increase by more than 66%.

Significant Rebound in Profitability

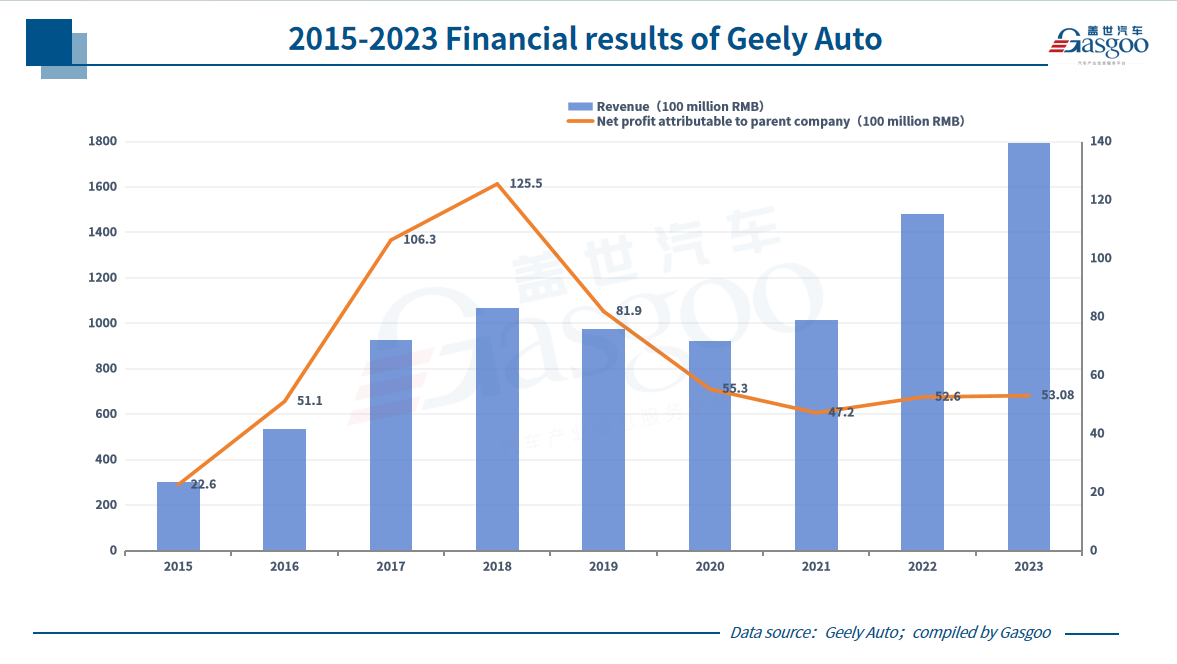

In recent years, the pressures of transitioning to NEVs, combined with intensified price competition, have significantly influenced the profitability of car makers, and Geely is no exception.

Data shows that from 2018 to 2022, the gross profit margin of Geely Auto declined by more than 6 percentage points over five years.

Geely Auto previously said that despite strict cost control measures, the expenses related to the transition to NEVs and the implementation of new sales models to enhance competitiveness have still led to increased costs.

However, according to the latest financial reports, Geely Auto's core profitability has significantly rebounded.

In 2023, Geely Auto achieved a revenue of ¥179.2 billion, a year-on-year increase of 21%, reaching a record high.

The net profit attributable to the parent company reached ¥5.308 billion, a 51% increase compared to the adjusted net profit of¥3.511 billion in 2022 (excluding one-time negotiated acquisition gains).

Geely Auto said that product optimization, cost reductions, and economies of scale have improved its gross profit, with total gross profit increasing by 31% year-on-year to ¥27.4 billion, and the gross profit margin rising from 14.1% in 2022 to 15.3% in 2023.

Looking ahead, with the comprehensive layout of NEVs completed, Geely Auto will continue to strengthen its industrial advantages and internal coordination and integration, expecting sustained improvement in profitability in the future.

At the 2023 Earnings Conference, Dai Yong, Deputy CFO and General Manager of the Financial Center of Geely Auto Group, pointed out that the positive impact of the synergy between products and technology at scale began to become evident in the second half of 2023.

The profit attributable to shareholders in the second half of 2023 increased by 138% compared to the first half. In 2024, with the introduction of more new products and an increase in sales, the scale effect is expected to further expand, thereby stimulating an improvement in profitability.

According to him, Geely brand, Lynk & Co, and Zeekr will introduce more targeted measures to further enhance profitability based on their scaling efforts.

For Geely brand, fuel vehicles will focus on six popular models built on two core architectures. For NEVs, leveraging the established reputation of the Galaxy series, Geely aims to improve marketing channels and increase brand awareness to expand market share. With a higher proportion of NEVs, the goal is to achieve sustained profitability through scaling.

In addition to launching new products, Lynk & Co will continue to enhance brand influence in Europe, focusing on retail. By utilizing the group's European resources, Lynk & Co plans to strengthen marketing channels and introduce new products to diversify its lineup. The launch of the new generation of Lynk & Co products aims to create star models, with the goal of reversing the loss in 2023 and restoring sustainable profitability.

Zeekr has set a sales target of 230,000 units, with new models entering more market segments and expanding into overseas markets. By exporting high-value products and increasing sales and gross profit, Zeekr aims to achieve a turnaround from loss to profitability.

To be the “Volkswagen Group” of the NEV Era

“Although auto industry has hit many new highs in 2023, 2024 will only get tougher and harder. “said Gan Jiayue, the CEO of Geely Auto Group, at the media conference of this spring festival.

According to the newly announced plan of Geely, in 2024, the Geely brand will launch a compact pure electric SUV. The Galaxy series will introduce a pure electric SUV and a plug-in hybrid SUV, continuing to target the market in the price range of ¥100,000 to ¥200,000.

Recently, the first pure electric SUV of Galaxy series is officially named "Geely Galaxy E5”, and has completed its debut on May 13.

The new models of Geely; photo credit: Geely

The Lynk & Co brand will aim at the high-end sports market, bringing three new energy products in 2024. Among them, the Lynk & Co 07 EM-P plug-in hybrid sedan may compete with BYD Han DM-i, and the first pure electric sedan of Lynk & Co, code-named E371, will also be mass produced. Additionally, a compact pure electric SUV will be introduced.

In addition to the Zeekr 007, which started pre-sales in November last year and competes with the Tesla Model 3, the Zeekr brand will add three new models this year, including the pure electric model Zeekr MIX, a medium to large luxury pure electric SUV, and a pure electric MPV.

To tackle the fiercely competitive automotive market, Geely is leveraging multiple product strategies to break through. However, winning this intense competition requires more than just products; it is a battle involving comprehensive capabilities.

An Conghui, Chairman of Geely Auto Group, stated that Geely plans to strengthen its systematic advantages in collaborative innovation through four aspects: architecture-based vehicle manufacturing, vertical integration, technology focus, and brand synergy.

The first is architecture-based vehicle manufacturing.

By utilizing architecture-based vehicle manufacturing, car makers can shorten development cycles, reduce R&D costs, and form a comprehensive, wide-ranging, and multi-level product matrix. According to An Conghui, architecture is a core competitive advantage.

Currently, Geely has four modular architectures: SPA, CMA, BMA, and SEA, targeting luxury, mid-range, compact, and pure electric models, respectively.

These architectures cover the development and manufacturing of various models across all levels. This year, main products of Geely will all be transferred to these four modular platforms for production, achieving comprehensive modular vehicle manufacturing.

The SEA (Sustainable Experience Architecture), as a pure electric intelligent architecture with the world's largest bandwidth, has empowered six brands and mass-produced 11 models last year. At present, the SEA architecture continues to evolve. Upcoming 800-volt SEA models include Zeekr 001FR, Zeekr 007, and Galaxy E8.

Additionally, a variety of new energy power routes of Geely, such as NordThor Powertrain, EM-P super range extension, battery swapping, and methanol-hydrogen integration are deepening coordination and accelerating evolution.

The second is the vertical integration of the industrial chain.

From an integrated technological ecosystem encompassing both sky and ground, to the core technologies of electrification and intelligentization, to smart manufacturing and energy replenishment systems, Geely is conducting full-stack self-development and vertical integration around the core areas of NEVs, accelerating self-innovation, and enhancing scale efficiency.

In the core technology of EV batteries, the so-called Gold Brick battery, which is fully self-developed from cells to battery packs, is not only used by Zeekr but also by other brands within the group.

In terms of energy replenishment, Zeekr launched the ultra-fast charging network plan last year.

Geely Galaxy will directly share this energy replenishment system, with charging protocols open to all brands under Geely Holding, including smart brand. More core technologies and products will be gradually opened and coordinated in the future.

The third is technology focus.

The advanced intelligent driving system self-developed by Geely focuses on high-frequency intelligent driving scenarios such as highways, urban NZP, and intelligent parking, and is being installed on an increasing number of models.

In terms of in-car systems, Geely has a self-developed solution based on the Qualcomm 8295 computing platform and has also introduced the Flyme Auto through Meizu car system, sharing core capabilities with other car systems. This platform has already been integrated into multiple models from Polestar, Lynk & Co, and Galaxy, with version 2.0 set to be released this year.

The fourth is brand synergy.

Behind multi-brand strategy, Geely Holding leverages technological synergy, scale benefits, supply chain competitiveness, and enhanced innovation capabilities to reduce R&D costs and improve market competitiveness for each brand.

"Geely Holding aims to become the Volkswagen Group of the NEV era." In the era of NEVs, Geely continues to be not only the careerist but the doer.

联系邮箱:info@gasgoo.com

求职应聘:021-39197800-8035

简历投递:zhaopin@gasgoo.com

客服微信:gasgoo12 (豆豆)

新闻热线:021-39586122

商务合作:021-39586681

市场合作:021-39197800-8032

研究院项目咨询:021-39197921