In-House Development: Building a Technological Fortress

In the fiercely competitive Chinese automotive market, Leapmotor emerged, maintaining its affordable, feature-rich models, consistently creating popular products, and moving toward the front of the industry. The secret to this success lies in technology.

With a clear strategic position, Leapmotor leverages technology to complete an entire development loop. By focusing on full-spectrum in-house development and vertical integration, Leapmotor has been able to lower costs, improve system-wide efficiencies, and deliver high-performance, feature-packed models that rival premium competitors, making its "value for money" strategy a reality.

Leapmotor positions itself as more than just a car manufacturer, it strives to be a technology provider.

According to Mr. Zhu Jiangming, control over technology is essential for gaining a competitive edge. Since its inception, Leapmotor has committed to full in-house development, a strategy that has gradually established a robust technical moat over the past decade.

Photo credit: Leapmotor

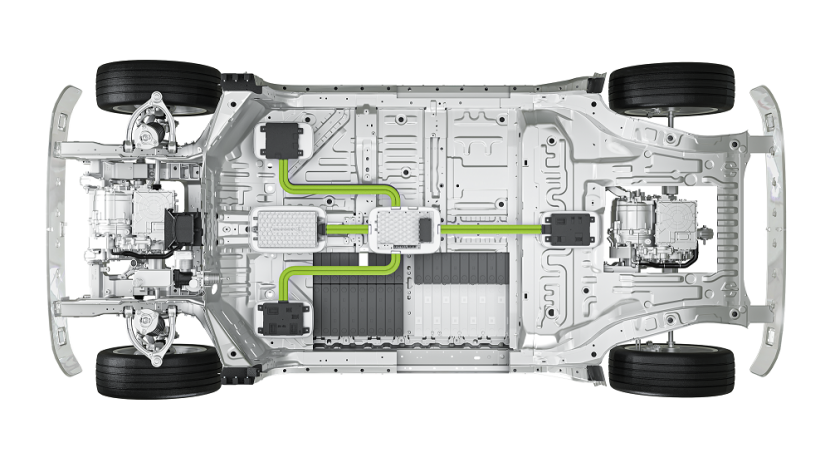

In 2018, Leapmotor's self-developed Heracles integrated electric drive system achieved mass production. In 2020, it unveiled the Lingxin 01, an automotive-grade AI chip co-developed with Dahua Technology, offering a maximum computing power of 4.2 TOPS and first featured in the Leapmotor C11. The following year, Leapmotor introduced its LEAP POWER advanced intelligent power technology, and in 2022, it became the first Chinese company to mass-produce 200kW oil-cooled electric drive systems and CTC (cell-to-chassis) battery technology. In July 2023, Leapmotor launched the "Four-Leaf Clover" architecture—a centralized design featuring one SoC and one MCU chip, and integrating cockpit, driving, power, and vehicle body domains.

After eight years of technical refinement, Leapmotor has built six core intelligent electric vehicle technologies and evolved from LEAP1.0 to LEAP3.0. In January 2023, it publicly unveiled these advancements, showcasing industry-first achievements like a four-domain integration central architecture, cockpit-driving-parking fusion via a single Qualcomm 8295 chip, OTA updates with no perceptible downtime, NAC urban full-scenario navigation, and a universal vehicle architecture compatibility rate of 88%, all of which have entered mass production.

Leapmotor's self-developed global vehicle architecture accommodates A0 to C-segment models, covering sedans, SUVs, MPVs, all-electric, and hybrid vehicles. The C10, introduced earlier this year, is the first globally-oriented model under the LEAP 3.0 architecture, and the flagship C16 model also features this advanced platform.

Leapmotor's C-series lineup recently received a comprehensive upgrade to the Four-Leaf Clover architecture, featuring the Qualcomm 8295 chip across all models and a suspension system with dual front wishbones and rear five-link suspension. This underscores Leapmotor's commitment to staying competitive in the intelligent connected vehicle arena.

Photo credit: Leapmotor

A significant advantage for Leapmotor is its stable R&D team, formed early on to specialize in core fields such as power systems, electronic and electrical architecture, intelligent connectivity, cockpit systems, and smart driving. The leaders of these six core technology divisions have remained unchanged, providing stability and continuity that have helped Leapmotor stay on track and achieve high cost-efficiency in R&D.

To date, Leapmotor has achieved complete autonomy over battery, electric drive, electronic control, intelligent cockpit, and smart driving systems, even opting to independently develop parts like headlights and bumpers. This approach has strengthened Leapmotor's product quality and cost control.

In addition, full-spectrum in-house development allows Leapmotor to use its technical expertise to further reduce costs.

For example, Leapmotor has achieved an 88% parts-sharing rate across models on the same platform, excluding design-specific components. Aside from benefiting cost control, ensuring consistent quality, and simplifying the supply chain, this move ultimately gives Leapmotor more negotiating power with suppliers. Leapmotor's platform architecture has undergone three iterations in five years.”

Leapmotor's self-developed CTC battery technology eliminates modules and top covers for an integrated design, reducing costs while enhancing comfort, handling, and safety. The C16 Smart Edition uses only one Qualcomm 8295 chip to manage Level-2 ADAS, a 360-degree camera system, automated parking, and sound adjustment. Mr. Zhu Jiangming emphasized, "This is something no other manufacturer has achieved; only Leapmotor maximizes the efficiency of a single chip through full-spectrum in-house development."

Within China's NEV market, only BYD, which controls over 70% of its components, rivals Leapmotor's vertically integrated supply chain. Leapmotor holds in-house control over 60% of its component costs.

Mr. Zhu Jiangming noted that Leapmotor's in-house development and production save on component markups. He explained that reducing the margin on parts by 10% results in a 6% cost reduction at the vehicle level. As Leapmotor's scale grows, the cost savings generated by its vertically integrated business pattern will either enable more competitive pricing or provide more attractive margins.

Leapmotor is further enhancing its cost advantage by investing in vertically integrated supply chains. The new electronics workshop at its Jinhua base will provide component support, with annual production capacities of 200,000 NEV battery systems, 250,000 sets of electric drives, and 200,000 sets of lighting assemblies.

On May 17, Leapmotor launched a key component project in Huzhou, Zhejiang Province, with an investment of approximately 1.35 billion RMB. This facility will produce heat pump compressors, electronic water pumps, and on-board electronic controllers, with a targeted annual output of 6.8 million sets of key NEV components. Once fully operational, the facility is expected to generate 4.3 billion RMB in annual output value and 300 million RMB in taxes.

Photo credit: Leapmotor

Through its full-spectrum in-house capabilities, Leapmotor has achieved cost control, establishing a differentiated competitive advantage in the mainstream 100,000-200,000 RMB market. Mr. Zhu Jiangming plans to expand Leapmotor's revenue streams by selling core components to other auto manufacturers in addition to complete vehicles.

Leapmotor has also expanded partnerships with major companies to enhance its smart technology. Recent collaborations include a strategic partnership with Ambarella in June to co-develop a full-stack intelligent driving solution based on the CV3 platform. On March 26, Mr. Zhu Jiangming announced a deeper collaboration with Qualcomm for single-chip multi-domain integration. On March 7, Leapmotor and Hesai Technology formed a strategic partnership to develop advanced LiDAR-based smart applications.

Leapmotor's network of collaborators continues to expand, propelling it forward in the smart automotive race.

Photo credit: Leapmotor

Leapmotor's Path to Self-Sustainability

Leapmotor's consistent focus on in-house development and manufacturing has made it one of the most efficient players among Chinese NEV startups in terms of capital utilization.

Over the past five years, Leapmotor has invested more than 5 billion RMB in R&D, achieving in-house design, production, and mass production of core components and eight vehicle models. As of the end of 2023, Leapmotor employed 2,929 R&D staff, accounting for 31.45% of its workforce.

Interestingly, compared to peers like NIO, Li Auto, and XPENG, Leapmotor’s R&D investment is relatively low. For instance, in 2023, NIO, Li Auto, and XPENG spent 13.43 billion, 10.59 billion, and 5.28 billion RMB on R&D, respectively.

Photo credit: Leapmotor

Mr. Zhu Jiangming acknowledges this difference but emphasizes Leapmotor's efficiency. "Leapmotor optimizes resource allocation across R&D, production, and marketing, ensuring effective use of funds in every aspect," he explains. With an R&D team that has accumulated over a decade of experience and maintained stability since 2015, Leapmotor's efficiency has translated into high returns. Mr. Zhu noted, "With leaders who understand the technology, the R&D team has a high output-to-investment ratio. Leapmotor can achieve significant results with relatively low spending."

This efficiency, driven by in-house development and vertical integration, has allowed Leapmotor to exercise strong cost control, as reflected in its financial performance.

Car making is a capital-intensive venture, and most NEV startups are still striving for profitability. While Leapmotor’s cost-driven pricing strategy has kept its model prices low, limiting per-unit profits, it has incurred cumulative net losses of over 15 billion RMB since 2019. Nevertheless, aware of these limitations, Leapmotor continues to focus on technological innovation and design optimization in its pursuit of profitability.

In 2023, Leapmotor generated 16.75 billion RMB in revenue, a year-over-year increase of 35.2%. Although it recorded a net loss of 4.22 billion RMB, this was an improvement from the 5.11 billion RMB loss in 2022.

In the third quarter of 2024, the company recorded a revenue of 9.86 billion RMB, marking an 83.9% surge quarter-on-quarter and a 74.3% spike year-on-year. Meanwhile, its net loss attributable to shareholders narrowed to 690 million RMB, down 30.3% from the year-ago period and 42.5% from the previous quarter.

Leapmotor's ability to "self-sustain" has notably improved, bolstered by optimized product structure, cost-reduction measures, and enhanced market competitiveness. After achieving positive gross margins in the third quarter of 2023, Leapmotor's 2023 gross margin reached 0.5%—a significant turnaround from -15.4% in 2022.

Due to the pressures of price competition in the Chinese auto market since the beginning of 2024, Leapmotor's gross margin faced challenges.

Leapmotor's gross profit margin reached 8.1% in the third quarter of this year, which grew from the 2.8% in the second quarter. The positive outcome is largely due to Leapmotor's optimized product mix, effective cost management, and economies of scale from higher sales volumes. Looking ahead to the fourth quarter of 2024, Leapmotor expects its gross margins to maintain an upward trend and net losses to further narrow.

Leapmotor attributed the reduced losses to steady growth in sales and revenue, improved gross margins, and tighter cost controls.

For Mr. Zhu Jiangming, scale is essential for Leapmotor. "Only when our sales surpass 200,000 units annually can we cover R&D costs across our full in-house resources." Mr. Zhu believes that ongoing cost reductions, overseas market expansion, and sales growth will drive down manufacturing costs and continue improving gross margins.

To streamline costs, Leapmotor has been restructuring its organization since 2022, focusing on efficient management to build competitiveness.

Photo credit: Leapmotor

Starting in September 2022, Leapmotor launched a cost-reduction initiative with six-month cycles, completing three rounds by the end of March 2024. These efforts included redesigning certain components of the C11 and C01 models, negotiating with suppliers for lower prices, and benefiting from battery cost reductions, reducing vehicle costs by over 3,000 RMB per unit. Additionally, optimizations in manufacturing process yielded a 1,000 RMB per unit reduction.

Leapmotor is preparing to enter its fourth cost-reduction cycle, a move that is expected to further strengthen its path toward self-sustained profitability.

Asset-Light Model: Leapmotor's Alternative Global Strategy

As competition intensifies in the Chinese auto market, capturing overseas growth has become essential for Leapmotor and other automakers. Leapmotor's approach is unique, forming a joint venture with global powerhouse Stellantis.

If the partnership between Volkswagen and XPENG signaled global recognition of Chinese automotive tech, Leapmotor's strategy of exporting both technology and products marks a new beginning for Chinese smart NEVs on the global stage.

In early September 2023, Leapmotor made its debut at the IAA Mobility in Munich, Germany, showcasing its latest in-house technologies as it entered a new phase of global expansion.

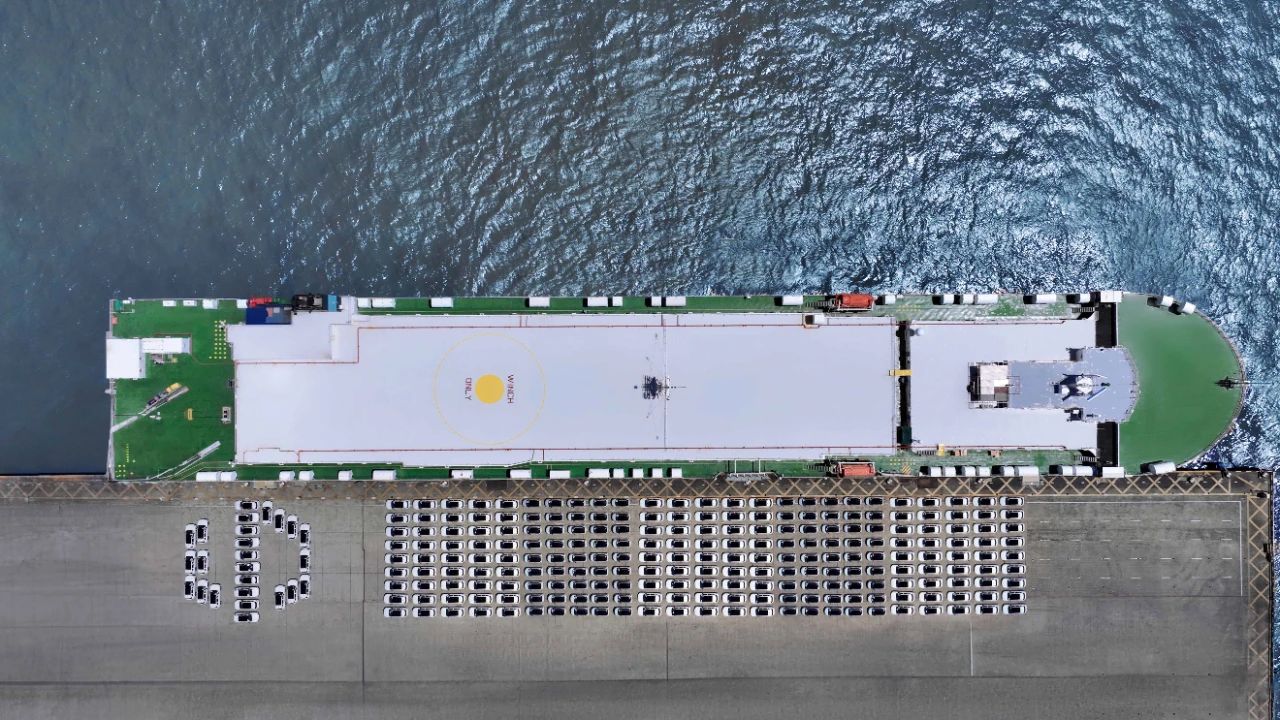

Just a month later, in October, Leapmotor formalized a partnership with Global OEM Stellantis. Stellantis committed to investing approximately 1.5 billion euros to acquire a 20% stake in Leapmotor. Together, they established a joint venture, Leapmotor International, in which Stellantis holds a 51% stake and Leapmotor 49%. This joint venture will handle export and sales operations outside of Greater China and exclusively manufacture Leapmotor vehicles for these markets. Less than a month after this agreement, the equity transfer was completed.

For Leapmotor, 2024 marks its first official year of overseas expansion. On March 6, Leapmotor announced that Leapmotor International had swiftly assembled its executive team, with operations officially beginning on May 14.

Photo credit: Leapmotor

Given the trade barriers and tariffs affecting Chinese NEVs, this asset-light model is a smart workaround, allowing Leapmotor to leverage Stellantis' extensive global network of distribution channels, after-sales service, and resources to accelerate and expand sales worldwide, establishing Leapmotor as an international brand.

On September 24, Leapmotor International officially launched its C10 and T03 models in Europe, marking the company's entry into the European market. Leapmotor International plans to expand its global sales network to 350 outlets by the fourth quarter of 2024, with a goal to release at least one new model annually over the next three years.

By the end of this year, Leapmotor's European market reach will include Belgium, France, Germany, Greece, Italy, Luxembourg, Malta, the Netherlands, Portugal, Romania, Spain, Switzerland, and the UK, supported by Stellantis’ sales network and brand management.

From the fourth quarter of this year, Leapmotor will also enter the Middle East and Africa, Asia-Pacific, and South America.

While the C10 is the first model introduced in Europe, Mr. Zhu Jiangming believes that the T03 will resonate better with European preferences and expects its sales to exceed those of the C10. Leapmotor International’s goal is to sell 500,000 vehicles outside China by 2030.

Photo credit: Leapmotor

Leapmotor has already developed a five-year product plan for overseas markets, tailoring its platform and scaling operations to meet the distinct demands of different regions and further reduce costs. The target in 2024 for overseas sales is 6,000 to 10,000 vehicles.

Of course, overseas expansion presents a host of challenges for China's auto industry. The addition of Stellantis as a shareholder is only the first step in a long journey.

Photo credit: Leapmotor

Competition in the 2024 auto market remains fierce.

BYD, with its massive scale-driven cost advantage, led the charge with price cuts, offering NEVs for less than comparable gasoline models in the 100,000-200,000 RMB range—a price bracket that Leapmotor also targets.

Meanwhile, XPENG and NIO have launched secondary brands targeting mass-market segments, adding further pressure. Compared to NIO, Li Auto, and XPENG, Leapmotor boasts product strength and innovation but lacks comparable brand recognition. With downward pressure on unit prices and uncertain prospects for improved margins, the question remains as to how far Leapmotor can go with sales scale and in-house cost reductions.

Leapmotor's answer is clear: focus on technology, build bestsellers quietly, and strive to go global.

联系邮箱:info@gasgoo.com

求职应聘:021-39197800-8035

简历投递:zhaopin@gasgoo.com

客服微信:gasgoo12 (豆豆)

新闻热线:021-39586122

商务合作:021-39586681

市场合作:021-39197800-8032

研究院项目咨询:021-39197921